EDO welcomes the introduction by the Federal Government of mandatory climate related financial disclosures through the Treasury Laws Amendment Bill 2024 (the Bill) that will mandate new reporting requirements through the Corporations Act 2001 (Cth). Improving financial disclosures will assist investors in understanding how a company is addressing climate change and the risks to a business associated with the climate transition.

The Government intends that the Bill will improve the quality of climate –related disclosures to support regulators assess and manage the risks to the financial system from climate change. They argue a rigorous climate disclosure regime will support Australia’s ability to attract international capital and investment for net zero transitions. It will also bring Australia into line with other jurisdictions including the EU, UK, New Zealand and Japan.

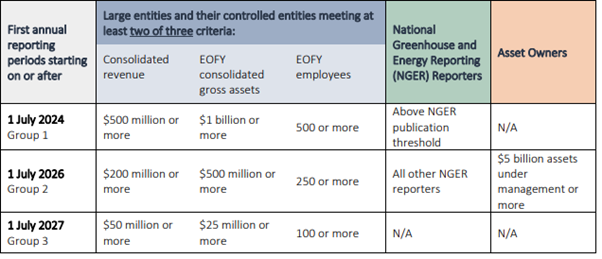

The requirements will be staged over the next few years and will apply to:

- Large companies covered by covered by Part 2M of the Corporations Act

- Asset owners with over $5 billion in funds

- Companies that have to report under National Greenhouse and Energy Reporting Act 2007.

A table summarising when mandatory disclosures will be required is set out below:

Importantly this includes companies who have to report under National Greenhouse and Energy Reporting Act 2007 regardless of size.

EDO supports the intention of the Bill but we also recommend that it should be strengthened. The Government is inviting feedback on the proposed legislation.

How the law could be improved

Modified liability is not necessary

The EDO is disappointed that the Government has chosen to continue with the modified liability approach that restricts the ability of third parties to enforce breaches of some types of climate disclosures. For the first three years of disclosures, only the regulator (ASIC) will be able to bring action relating to misleading disclosure of scope 3 emissions and scenario analysis. The modified liability also restricts the remedies available to ASIC for any misleading disclosures for these areas to injunctions and declarations. Without this restriction, ASIC would usually be able to seek civil penalties for a breach of the Corporations Act. This waters down ASIC’s enforcement powers at a time when greenwashing is prolific. The imposition of penalties sends a strong message to the market and acts as a deterrent.

These restrictions will prevent third parties commencing actions to make companies accountable who mislead in their scenario analysis or scope 3 disclosure. As ASIC has limited resources, third parties must also enforce any breaches to ensure companies remain accountable. The EDO has commenced proceedings against two companies, Santos and Woodside, in relation to misleading or deceptive net zero claims.1

The EDO believes removing third-party enforcement rights has the unintended consequence of delaying urgent climate action by permitting entities to engage in greenwashing, without sufficient accountability mechanisms. The “reasonable grounds” standard contained in misleading or deceptive conduct provisions is sufficiently flexible to accommodate the uncertainties inherent in forward-looking statements. Companies have already been on notice for some time that disclosure requirements would become mandatory, and many are already disclosing their scope 3 emissions, as required in other jurisdictions. There is no need for further respite from these requirements when there is an urgent need for climate action.

Scenario analysis should be science based

The Bill also requires the use of climate scenarios which are designed to provide advice on the risks from climate change and provide possible solutions in terms of future analysis of how to reduce greenhouse gas emissions. The Government is requiring companies to use at least two possible future scenarios, one including a modelled pathway for emissions reductions consistent with 1.5 degrees. This enables companies to choose a 1.5 scenario with which to align and another scenario with reductions that result in higher than 1.5 degrees.

The EDO believes that entities scenario pathways should be consistent with the latest IPCC and IEA modelled pathways that limit warming to 1.5 degrees. The IPCC and IEA modelled pathways are science based and enable a consistent point of comparison for investors. The ability to choose scenarios will impact on the consistency and credibility of the emissions reduction pathways used by companies and continue to result in scenario shopping. This is because climate scenarios that achieve the same long-term temperature goal of “well below” 2°C may vary considerably in terms of energy and land use requirements, technology deployment and temperature overshoot, making comparisons difficult.

Quantity or Quality?

The proposed Bill requires qualitative scenario analysis of climate risk for the first three years, with quantitative scenario analysis only required after 1 July 2027. Scenario analysis is a method for developing strategic plans for addressing climate risk which helps investors understand how vulnerable the company is to transition and physical risks of climate. Qualitative analysis relies on descriptive, written narratives while quantitative relies on numerical data and models. The Taskforce on Climate-related disclosures recommended more in depth scenario analysis using quantitative methods for industries more affected by transition risk.2 Aspects of the Australian economy such as mining, energy, insurance and banking are impacted significantly by transition risk and extreme weather events caused by climate change. To understand the impacts on a particular company, more in depth quantitative analysis is required.

Submissions

Submissions can be made on the Exposure Draft legislation and accompanying explanatory materials by 9 February 2024 via email at [email protected]. More information is available on the Treasury website.

1 https://www.edo.org.au/2023/12/19/federal-court-challenge-launched-against-woodside-over-alleged-greenwashing/, https://www.edo.org.au/2022/08/25/australasian-centre-for-corporate-responsibility-expands-landmark-federal-court-case-against-santos/

2 https://www.tcfdhub.org/Downloads/pdfs/E04%20-%20Section%20D%20-%20Scenario%20Analysis.pdf